Market Commentary – February 20, 2026

by: Chris Betz

| Corn | Soybean | Wheat | |||||||

| Old Crop (futures month, change, settle price) | CH6 | 1’6 | 427’4 | SH6 | 3’4 | 1137’4 | WH6 | 14’0 | 573’4 |

| New Crop (futures month, change, settle price) | CZ6 | 3’0 | 464’4 | SX6 | 3’2 | 1115’0 |

WN6 | 13’0 | 587’4 |

Technical Thoughts – February 19, 2026

By: Ken Lake

USDA will release its first look at 2026 corn and soybean production later this morning from their annual Outlook Forum. International Agribusiness Group released its estimate yesterday pegging corn at 95 million acres down 4 million from 2025 and soybeans at 85 million acres up 4 million from 2025. These estimates are just that estimates and not necessarily market movers. The only number that counts will be released in USDA’s final planted acreage report which be released on June 30th.

Until then the futures spreads should be the key as to what the market really thinks. Currently the July:Dec corn spread has moved out to 16 cents carry bringing light to the fact that traders see no supply problem. Additionally, the Dec26:Mar27 spread is displaying a 12-cent carry, again, the market offering little incentive to move corn into the market. That’s why spot corn basis is doing the heavy lifting, trying to find a value that moves corn into the market. So far, the commercial elevators have been satisfying end user’s needs. This would be a suitable time to remind producers that as of Dec 31st, Michigan farms held 20 million bushels more corn than they did a year ago and more than double the amount that was in commercial elevator hands (225 million vs 91 million as of Dec 31). This offers two outcomes. At one point farmers will hold practically all the corn in Michigan and the market will have to come to them. On the other hand, if farmers wait too long, they will likely be faced with heavy competition from their neighbors as the bins get cleaned out.

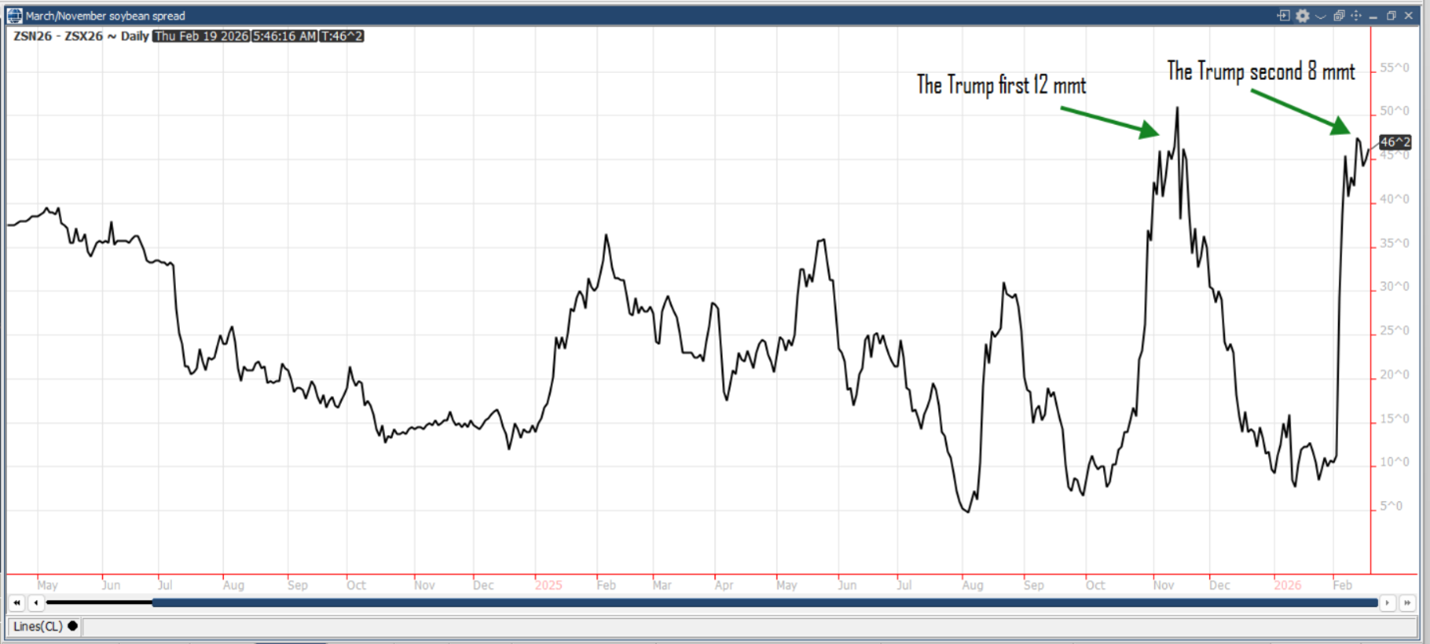

Soybeans offer a different look. The July:Nov spread is inverted by 45 cents offering no incentive to carry soybeans, the demanding them now. This pattern mirrors what we saw during Trump’s first 12 mmt “deal” with China the peaked in early November. You should be reminded that we saw that peak and subsequent collapse well before USDA announced the actual sales to China. The current move higher in soybeans is clearly fueled by spec demand but may also be fueled by long hedging on behalf of the Chinese IF they are covering their newest commitment to Trump. Another classic, buy-the-rumor, sell-the-fact move.

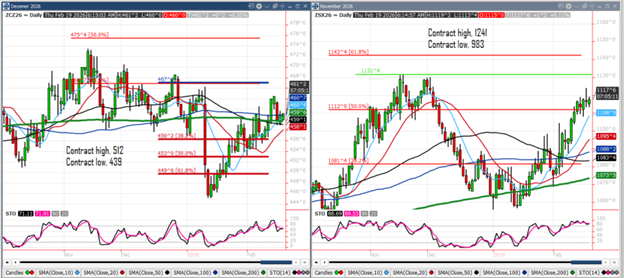

March corn is once again testing support at 425. The 10/20-day moving averages are turning more bearish as they hint at moving back to a bearish cross. Basis contracts need to be priced. Old crop corn needs to be sold. The March:May spread has built in 10 cents carry, the March:July, 18 cents carry. If nothing else, sell the carry and plan to empty the bins.

March soybeans are moving sideways near 1135. Upside targets remain 1150,1172 with support at 1125. The sell stop is 1117.

December corn continues to test 460 support. The spring crop insurance price guarantee is currently 459. A year ago it settled at 470. Corn remains fundamentally bearish. Establishing a floor here makes sense.

November soybeans continue to trade above 1112 support. Upside targets are 1131, 1142. Chart support is 1108. The sell stop is 1081.

Both old and new crop wheat contracts gapped higher overnight after a positive day yesterday. March wheat is trading above its 200-day moving average, now 550. A close above 550 is needed in order to advance.

July wheat has yet to test is 200-day moving average, now 570, but is getting close. Note the 50% Fibonacci resistance point at 571. Advance sales at 570.